If you earn income above certain thresholds your Social Security benefits could be reduced and you may owe income tax on them as well. That could reduce your benefit amount, make some of your benefits taxable or both. Also, think about whether you plan to continue working in some capacity while receiving Social Security benefits. You can also use a Social Security benefits calculator to estimate how much you’ll receive at age 62, 66 or age 70.īeyond that, however, consider the bigger picture and how things like changes to your health or rising inflation might affect your timing. These calculators also don’t factor in the amount of benefits your surviving spouse might receive if you were to pass away.ĭeciding When to Take Social Security BenefitsĪ Social Security break-even calculator can be a good starting point for deciding when to take Social Security benefits.

How much tax you’ll owe, if anything, on those benefits

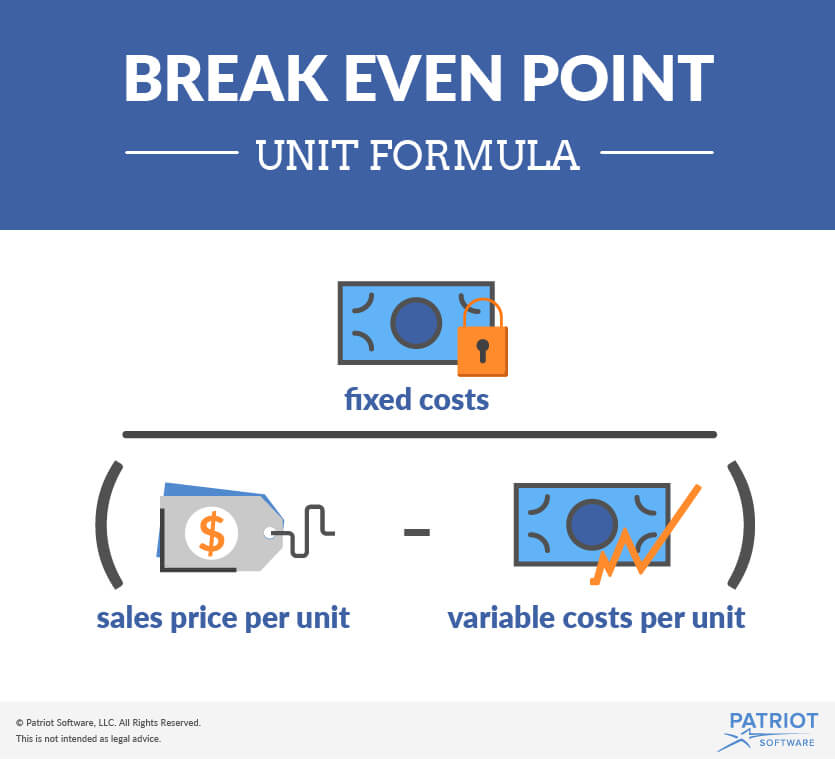

They don’t take into things that could affect your ability to draw benefits or how far those benefits might go, such as:įuture cost of living adjustments to Social Security benefits What you have to keep in mind when using a Social Security break-even calculator is that the numbers are hypothetical. But that could be a big “if” when you’re not in the best health. You can see that you’d draw the most Social Security benefits in total if you wait until age 70 to start taking them, assuming you live to age 100. Here’s how your total benefits received would look over each of those periods, for all three starting points. In a nutshell, a Social Security break-even calculator can tell you when the best age is to start taking Social security benefits, in terms of how much money you could expect to receive over time. Going back to the previous example, let’s assume that you track your benefit amounts over a 10-year, 20-year and 30-year period. A Social Security break-even calculator can help you get some perspective on the numbers so you know what you stand to gain or lose by taking benefits earlier versus later.Įlderly woman calculates her Social Security benefits How a Social Security Break-Even Calculator Worksįiguring out the right time to start taking Social Security benefits isn’t always a straightforward process. Your actual Social Security break-even age can depend on the amount of benefits you’re eligible to receive, your tax situation and things like how inflation might affect the purchasing power of your benefits. Your break-even age is the point at which you’d come out ahead by delaying Social Security benefits. So the trade-off is receiving fewer checks from Social Security but the ones you do get would be larger. If you wait until age 70 to start claiming your benefits, you’d receive 132% of your regular monthly benefit amount.

#BREAK EVEN POINT FORMULA CALCULATOR FULL#

Currently, the full retirement age for most people is either 66 or 67 years old, based on Social Security Administration guidelines. On the other hand, delaying your benefits past full retirement age increases them year over year until you reach age 70. But by taking your benefits at this earlier age, you’ll receive more Social Security checks over your lifetime assuming you reach your desired life expectancy. Remember, you can begin taking your benefits at age 62 at a reduced amount. Your Social Security break-even age represents, in theory, the ideal point in time to apply for benefits in order to maximize them. Social Security Break-Even Age, Definition Additionally, it may behoove you to consult with a financial advisor about when it’s best for your particular situation to begin receiving Social Security benefits. You can do that using a Social Security break-even calculator. Calculating your Social Security break-even age can help you decide when the best time is to begin taking benefits.

On the other hand, you could delay taking benefits up to age 70. While you can technically start taking benefits as early as 62, you’d receive them at a reduced amount. Couple reviews their Social Security benefitsĭeciding when to take Social Security retirement benefits is important because it can directly affect your benefit amount.

0 kommentar(er)

0 kommentar(er)